550$ Annual Fee

The American Express Platinum card is probably the most iconic premium travel credit card available to the general public. Although American Express has faced some stiff competition with other major banks offering competing products, they have done a great job at keeping the Platinum card the luxury credit card to have.

The Platinum card comes in a beautiful package with a wooden frame holding the card in place.

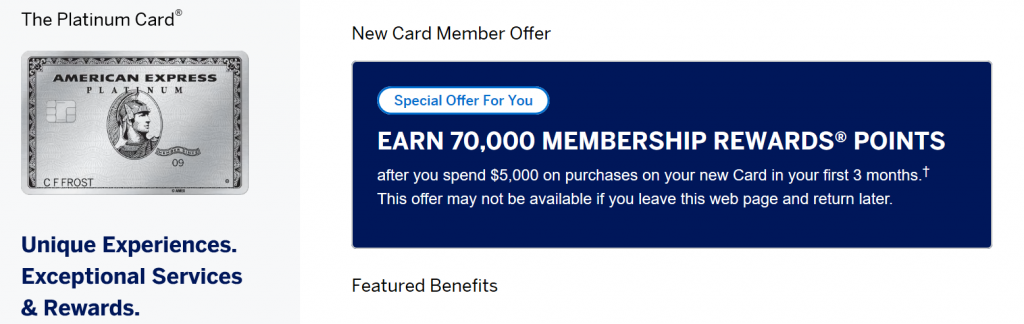

Signup Bonus

The Platinum card offers a signup bonus of 70,000 points after spending 5,000$ in 3 months. While not the largest bonus we’ve seen for this card, those 70,000 points alone are worth more than the 550$ annual fee.

Who is This Card For?

The Platinum card is perfect for frequent travelers looking for well rounded travel benefits, access to a wide range of airport lounges, and industry leading customer support.

Card Benefits

200$ Airline Incidentals Credit

A credit of up to 200$ per calendar year is applied towards incidental purchases with a US airline of your choice. Unlike some other cards which offer unrestricted travel credit which can be used towards airfare, trains, or even taxis, this credit only covers incidental charges like change fees, seat upgrades, baggage cost, and in flight purchases. Anyone who flies at least a few times per year on a US airline should be able to make use of this 200$ credit.

Priority Pass Select Membership

Both the primary cardholder and authorized users receive complementary Priority Pass Select membership. This card provides free unlimited entrance to Priority Pass’ collection of over 1300 partner lounges worldwide for the cardholder and up to two guests per visit. Priority Pass is great for travelers flying in economy class without lounge access to be able to access an airport lounge before their flight.

Get free access to the Air China first class lounge in Beijing with your Priority Pass membership!

Air China First Class Lounge

Air China First Class Lounge

Air China First Class Lounge

Air China First Class Lounge

For more information on Priority Pass and a list of lounges you can access with the card, click here.

Centurion and Delta Sky Club Lounge Access

American Express operates a handful of their own Centurion airport lounges at many major airports which are open only to Platinum and Centurion cardholders.

Access the Centurion Lounge at Hong Kong airport for free by presenting your Platinum card.

Centurion Lounge Hong Kong

Centurion Lounge Hong Kong

Centurion Lounge Hong Kong

The Platinum card also offers the primary cardholder access to Delta Sky Clubs when flying with Delta or a partner airline.

Hilton Honors and Marriott Bonvoy Elite Status

Both the primary cardholder and authorized users receive complementary Hilton gold and Marriott gold status as long as they remain Platinum cardholders.

200$ annual Uber credit & 100$ annual Saks Fifth Avenue credit

Cardholders receive a 15$ credit per month towards Uber rides in the US (20$ in December) as well as two 50$ credits at Saks Fifth Avenue in the first and second half of each year.

Three Additional Cards for 175$

One benefit that should be a no brainer for many, is to get three additional cards for 175$ total (additional 175$ per one card thereafter). These additional cardholders will receive a new physical platinum card in their name and be entitled to additional benefits like Priority Pass membership and Hilton and Marriott Bonvoy elite status. At under 60$ per extra card, these benefits should massively outweigh the cost.

Bonus Point Categories

Cardholders receive 5x points spent on airfare as well as hotels booked through Amex Travel. All other purchases earn 1x point.

Transfer Partners

My favorite way to redeem Membership Rewards points is by transferring them to other airlines or hotel groups. You can transfer points to most airline and hotel groups at a 1:1 rate, however Amex does run promotions throughout the year, offering up to a 50% bonus on points transferred, making the redemption even better!

Airline Transfer Partners

There are currently 22 airline and hotel transfer partners including Delta, British Airways, Cathay Pacific, Singapore Airlines, Qantas, Hilton Hotels, and more.

Customer Support

Having been a client at all major banks in the US for several years, I’d say American Express consistently provides the best customer service. Hold time to speak with a representative is normally just a few seconds and most representatives are professional and knowledgeable on all card details and benefits. I feel confident putting my most expensive purchases on my Platinum card knowing I have the best customer support behind me should anything go wrong.

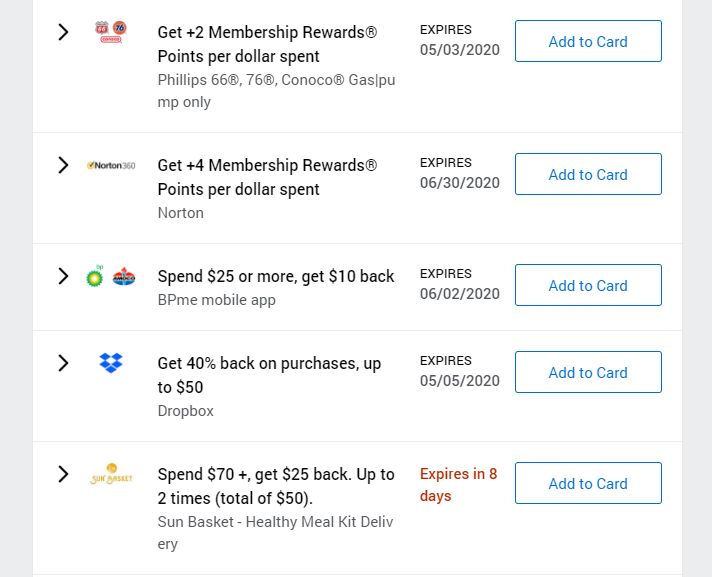

Amex Offers

American Express publishes various deals throughout the year, offering bonus points or cash back on purchases made with specific companies. The offers have a wide range from hotels to Amazon products to online services and software.

Bottom Line

The American Express Platinum card sells a lifestyle more so than a credit card. I have only highlighted some of the benefits as it would be too much to list them all. I’ve gotten outsized value from the various benefits offered by this card and can’t imagine ever canceling it.