$250 Annual Fee

The American Express Gold card is almost in a category if it’s own with a unique annual fee and card benefits. This is certainly not the right card for everyone, but certain people will get a lot of value from this card.

Signup Bonus

The Gold card offers a signup bonus of 35,000 points after spending $4,000 in 3 months. While not the largest bonus offer we’ve seen for the Gold card, the 35,000 points are still worth more than the $250 annual fee.

Who is This Card For?

The Gold card is perfect for those looking to earn American Express points without paying the Platinum card’s high annual fee. The Gold card has excellent points earning rates on dining and US supermarket purchases, so those of you who typically spend a lot in those categories will benefit from the extra points.

$100 Airline Incidentals Credit

A credit of up to $100 per calendar year is applied towards incidental purchases with a US airline of your choice. Unlike some other cards which offer unrestricted travel credit which can be used towards airfare, trains, or even taxis, this credit only covers incidental charges like change fees, seat upgrades, baggage cost, and in-flight purchases. Anyone who flies at least a few times per year on a US airline should be able to make use of this $100 credit.

Transfer Partners

My favorite way to redeem Membership Rewards points is by transferring them to other airlines or hotel groups. You can transfer points to most airline and hotel groups at a 1:1 rate, however Amex does run promotions throughout the year, offering up to a 50% bonus on points transferred, making the redemption even better!

Airline Transfer Partners

There are currently 22 airline and hotel transfer partners including Delta, British Airways, Cathay Pacific, Singapore Airlines, Qantas, Hilton Hotels, and more.

$120 Monthly Dining Credit

Cardholders receive a $10 monthly dining credit which can be used at select restaurants and food delivery services like Seamless and Grubhub. This is an interesting and unique card benefit, however I’m mainly interested in travel related benefits when choosing a credit card.

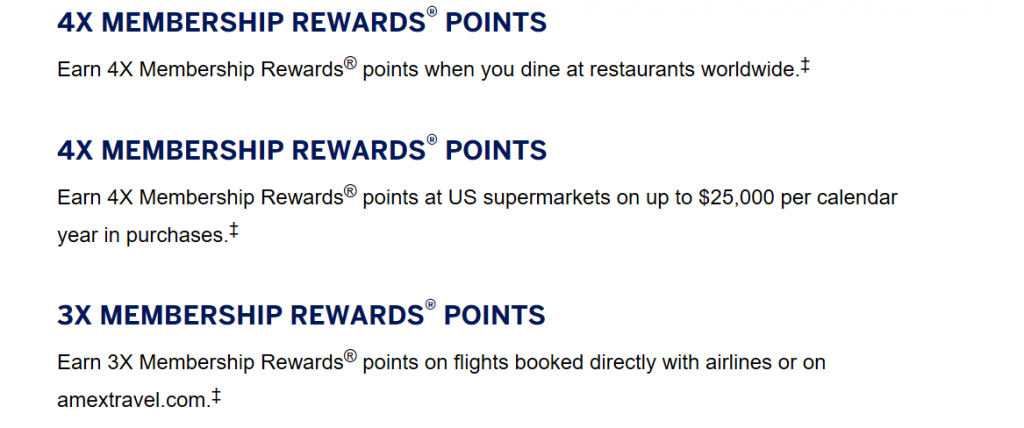

Bonus Point Categories

Cardholders receive 4x points spent on restaurants and US supermarkets and 3x points on airfare. All other purchases earn 1x point.

Baggage Loss Insurance

Cardholders receive a reimbursement of up to $1,250 per carry-on bag and up to $500 per checked bag when lost, stolen, or damaged on all forms of transport including air travel, busses, and trains.

Bottom Line

The Amex Gold card is an interesting credit card to consider. This is by far the most expensive mid range travel credit card, and the price is only justified for those who will make use of the card’s unique benefits. I prefer paying a higher price for one of the premium travel cards or a lower price for another good mid range travel card.