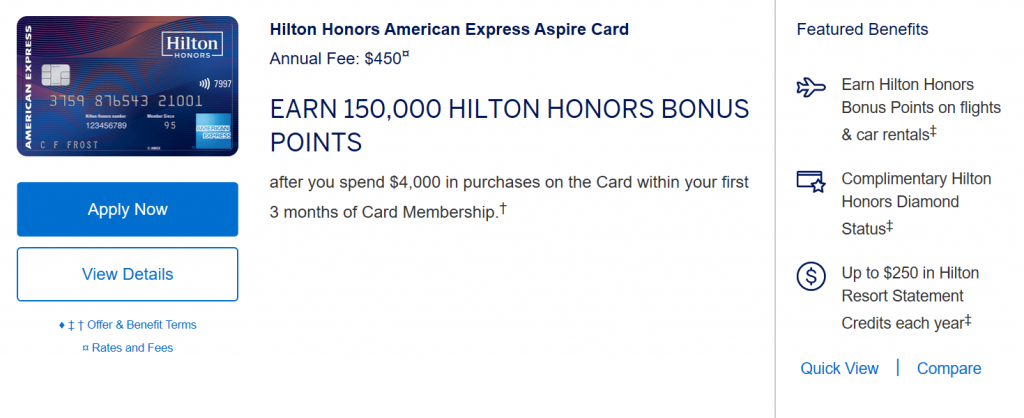

450$ Annual Fee

The Hilton Aspire card is one of the newest premium travel credit cards to be issued by American Express and comes with some amazing perks which more than offset the 450$ annual fee. I picked up this card just weeks after it became available and couldn’t be happier with the value I’ve gotten until now.

Signup Bonus

The Hilton Aspire card has a signup bonus of 150,000 points after spending 4,000$ in the first 3 months of card membership. I value Hilton points at 0.5 cents each, so this bonus is worth about 750$ which is quite generous. These points can be redeemed towards free nights at any Hilton property worldwide.

Who is This Card For?

The Hilton Aspire card is perfect for frequent travelers looking to elevate their hotel experience with Hilton. For travelers who are only spending a few nights per year with Hilton, you might want to consider the Hilton Surpass card for great Hilton benefits at a lower fee.

Card Benefits

Hilton Diamond Status

The primary cardholder receives Hilton’s top tier elite status as long as you have the card. With Diamond status, I’ve gotten tons of added value on my many recent Hilton stays including:

-Room Upgrades

-Free Breakfast

-Execuitive Lounge Access

-Early check in/late check out

Conrad Beijing Suite Upgrade

Conrad London Suite Upgrade

Waldorf Astoria Dubai Suite Upgrade

DoubleTree Cape Town Suite Upgrade

Hilton Colombo Suite Upgrade

Hilton Helsinki Suite Upgrade

Conrad Bali Suite Upgrade

For a full list of Hilton elite benefits, click here.

I’ve been staying almost exclusively at Hilton hotels and have been so impressed by the elevated experience due to my Diamond status.

250$ Hilton Resort Credit

The primary cardholder receives a 250$ credit for any purchase (including room rate) at any of Hilton’s Resort properties each calendar year. Some popular Hilton resorts include the Conrad Maldives Rangali Island, Conrad Bali, and Waldorf Astoria Dubai, all of which I’ve stayed at and redeemed my credit on room rate, activates, and food.

Redeem Your Credit at the Waldorf Astoria Dubai Palm Jumeirah!

Discover all Hilton Resort properties worldwide here.

200$ US Airline Incidentals Credit

A credit of up to 200$ per calendar year is applied towards incidental purchases with a US airline of your choice. Unlike some other cards which offer unrestricted travel credit which can be used towards airfare, trains, or even taxis, this credit only covers incidental charges like change fees, seat upgrades, baggage cost, and in flight purchases. Anyone who flies at least a few times per year on a US airline should be able to make use of this 200$ credit.

Priority Pass Select Membership

The primary cardholder receives complementary Priority Pass Select membership. This card provides free entrance to Priority Pass’ collection of over 1300 partner lounges worldwide for the cardholder and up to two guests per visit. Priority Pass is great for travelers flying in economy class without lounge access to be able to access an airport lounge before their flight.

Get free access to the Air China first class lounge in Beijing with your Priority Pass membership!

Air China First Class Lounge Beijing

Air China First Class Lounge Beijing

Air China First Class Lounge Beijing

For more information on Priority Pass and a complete list of lounges you can access, click here.

Annual Weekend Free Night

One of my favorite card benefits, the primary cardholder may redeem one free night at nearly any Hilton property for a weekend night stay. This is an excellent opportunity to stay for free at some of Hilton’s most expensive properties.

In my first two years since getting the card, I’ve redeemed my free nights at the Conrad Hong Kong and Waldorf Astoria Jerusalem.

Redeem Your Free Night at the Conrad Hong Kong!

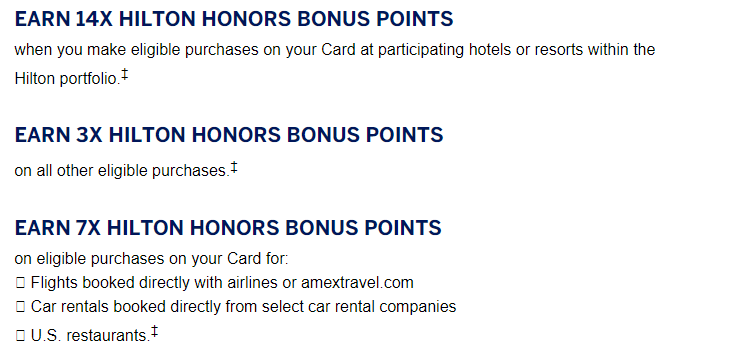

Bonus Spend Categories

The Hilton Aspire card offers an attractive bonus of 14x points spent at Hilton properties worldwide. You’ll also earn 7x points on airfare, car rentals, and US restaurants, and 3x points on all other purchases.

This is easily my go to card for Hilton purchases, but I prefer either the American Express Platinum or Citi Prestige for airfare and restaurant purchases.

Bottom Line

The Hilton Aspire is one of my favorite credit cards which I can’t imagine canceling anytime soon. The benefits are specifically geared towards hotel stays, so this card is best paired with another which offers a wider range of travel benefits like the American Express Platinum or Citi Prestige for the most inclusive luxury travel benefits.

For a full list of card benefits, click here.