495$ Annual Fee

Citibank’s premium travel credit card offers some unique benefits which make this card a compelling option for frequent travelers.

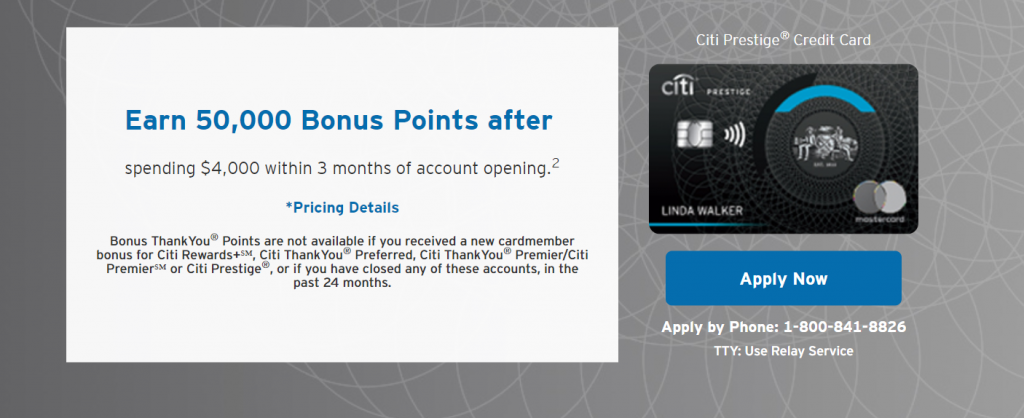

Signup Bonus

The Citi Prestige card currently offers 50,000 Citi Thankyou points after spending 4,000$ in the first 3 months of card membership. We’ve seen higher bonuses on this card before, however the 50,000 point offer is still quite good and easily worth more than the card’s annual fee.

Who is This Card For?

The Citi Prestige card is perfect for frequent travelers looking for well rounded travel benefits and high Thankyou points earnings. This card is the obvious choice for Citigold clients who receive an additional 145$ statement credit for having this card. For semi frequent travelers who aren’t able to make use of all the card benefits, I’d recommend the less expensive Citi Premier or Chase Sapphire Preferred card.

Card Benefits

250$ Travel Credit

The primary cardholder receives a 250$ travel credit each card member anniversary to be spent on any travel expenses including airfare. Unlike American Express cards which only offer “travel incidental” credit, covering things like baggage fees or seat upgrades, this credit is good for ANY travel purchase.

Priority Pass Select Membership

Both the primary cardholder as well as any additional cards on the account receive complementary Priority Pass membership. You’ll have access to Priority Pass’ collection of over 1300 partner lounges worldwide for the cardholder and up to two guests per visit. Priority Pass is great for travelers flying in economy class to be able to access an airport lounge before their flight.

Access the Skyteam Lounge in Dubai with your Priority Pass!

Skyteam Lounge

Skyteam Lounge

Skyteam Lounge

For more information on Priority Pass and a list of lounges you can access with the card, click here.

Citigold 145$ Statement Credit

Citigold clients earn a 145$ statement credit each year of card membership. This effectively brings the annual fee cost down to just 350$ compared to the 550$ you would pay for either the Chase Sapphire Reserve or American Express Platinum.

Bonus Point Categories

Cardholders receive 5x points spent on air travel and dining, 3x points on hotels and cruises, and 1x point on everything else. Compared to the Amex Platinum and Chase Sapphire Reserve cards, the Prestige has the most generous bonus point categories.

Transfer Partners

Citi Thankyou offers cardholders 15 partner airlines where you can transfer your points 1:1. The best airline transfer options include Turkish Airlines, Singapore Airlines and Cathay Pacific.

Fly Turkish Airlines business class by transferring your Thankyou points to Turkish Airlines Miles & Smiles program.

Turkish Airlines 777 Business Class

Hotel 4th Night Free

Cardholders receive their 4th night free on all hotel bookings made with Citi Thankyou.

This benefit was recently devalued as cardholders were previously allowed unlimited use of this benefit, however you are currently allowed up to two uses per calendar year. There is no cap on the hotel cost, so you can potentially get a lot of money back when booking at least four nights at high end properties.

Cell Phone Protection

Cardholders who pay their monthly cellular bill with the Prestige card are entitled to up to 1,500$ in yearly reimbursements if your phone is damaged or stolen. This is one of the Prestige card’s most interesting benefits that many of you will find useful.

75$ Per Extra Card

You can request additional cards for family or friends for just 75$ per card. Each additional cardholder is entitled to some benefits including a Priority Pass membership, however not an additional 250$ travel credit.

Bottom Line

I have only highlighted some of this card’s many benefits as it would be too long to list them all. The Citi Prestige card offers many of the benefits that should be expected from a premium travel credit card and more. Most travelers will easily find that the benefits offered are worth more than the annual fee!

For a full list of card benefits, click here.